Re-published from Dialogues, United States Association for Energy Economics By Jennifer Warren

With less than 100 days into a new administration, the Trump administration has indicated new directions in energy policy. A comprehensive vision of U.S. energy policy has not been articulated however. America's energy landscape is dynamic and markets have considerable sway. The fundamentals of supply, demand, price and technological advances continue to push and pull the energy mix, shaping the amalgam that is U.S. energy. Notably, several key areas were emphasized on the campaign trail and contours of policy are echoing those pledges.

Conventional sources

The oil and gas industry was an obvious constituent that Trump wanted to support. The opening up of federal lands for more drilling was a campaign item. As an indication of support for the oil and gas industry, on January 24th, Trump signed a presidential memorandum that indicated movement on construction of the Keystone XL and Dakota Access pipelines. The $4.2 billion Rover pipeline, stretching from Pennsylvania to Ontario, was also advanced by the Federal Energy Regulatory Commission, where bottlenecks and economic impacts were stymieing the flow of natural gas.

As for policy directions and drilling on public lands, according to Amy Jaffe, executive director of Energy and Sustainability, University of California-Davis, "Trump has been direct in saying that he wants the oil and gas industry to be healthy and expand because it is important for the country." She continues, "Drilling on public lands is a bit of red herring. Companies know where the resources are and where there is infrastructure in place, for example in the Permian or Marcellus." The question she poses: "Do they want to drill on federal lands in other locations that lack infrastructure when you have this existing lower-48 resource base on private lands [via shale] all ready for the market."

As mentioned in a recent natural gas article, the idea of a trade spat with Mexico isn't a favorable development for U.S. natural gas producers, refiners or midstream firms. In the last several years, Mexico has increased its consumption of U.S. natural gas. A number of U.S. firms have added Mexico's market to their business plans, a new opportunity that formerly did not exist. In an era with the potential for excess supply and ample capacity, export markets like Mexico have served as a relief valve, helping buoy various oil and gas industry players during a downturn that is turning upward. The U.S. oil and gas industry has evolved with technological change under the pressures of a competitive global market and holds a position of strength.

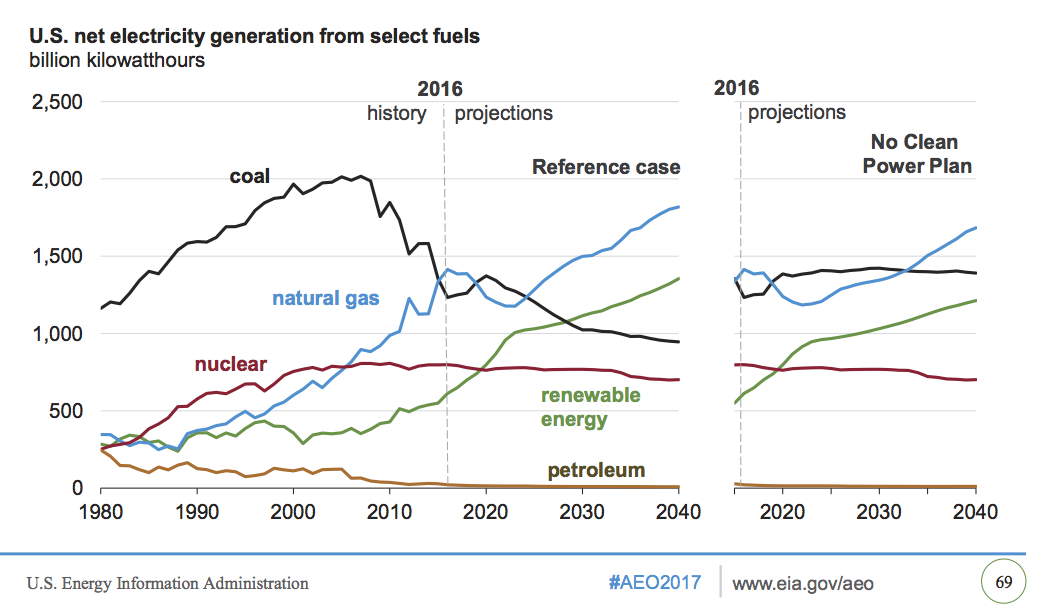

Relief to the coal industry is the other major pledge with policy implications. The Clean Power Plan (CPP) was a major policy measure that was expected to shape and refine energy consumption and power generation. The Energy Information Administration projects a 26% decline between 2015 and 2040 in coal production with CPP implementation. Without the CPP, they expect production to remain at 2015 levels.

Alternative energy

In conversation with Jaffe, she mentions that the majority of states are implementing the clean power plan because these clean energy initiatives were already in motion. She does not expect these states to reverse course. "Some utilities are moving away from coal because natural gas is cheaper, or because shareholders will not invest in coal generation," she notes.

Additionally, more Fortune 500 companies are committed to using clean energy. The Googles and Walmarts are announcing to stakeholders that they intend to be 100% renewable by certain dates. "Therefore, as a firm, you have to be in a state that supports renewables," she says.

There is a flip side, Jaffe refers to as a fault line, "But to have the renewables, there can be a problem if higher costs get kicked over to fixed income folks. The perception is that flush Google-type firms are benefiting from federal tax credits when they buy renewables, while some of the costs are borne in the overall rate base by regular, working people." This is an example of the rise of the contention between the 'elites versus the rest' that has changed the political landscape of late. Jaffe suggests, "There maybe some temporary reprieve from electricity reform [under Trump], but that may wind up being more about the pace of change than the fact that change is coming."

The climate change agenda is a broad and diffuse issue that has many arteries. In these initial days, and given the weight of other issues such as trade, security and economy, this item may not be a high priority for the administration. However, executive orders to roll back the Clean Power Plan, the Climate Action Plan and the Paris Agreement are said to be on the horizon.

Jaffe offers, "At UC Davis, we talk about “the three transportation revolutions” — automation, shared mobility and electrification. These technologies will come forward but not because of climate change policy. In both developing and developed countries, traffic congestion is a real problem. Firms like UPS and FedEx are using big data to save on fuel and labor costs, offers Jaffe. At UPS, after implementing computer-based route planning, they saved 100 million vehicle-miles traveled in the U.S. with that program. "If we were to cede [our advances in technology] to China, that would be a disaster for American jobs," says Jaffe.

"It remains to be seen how automation and clean technology shakes out with respect to economic planning over this Administration," observes Jaffe. "Politicization exists but energy technology and clean tech are important as a source of competitiveness in the U.S.," says Jaffe. Advances in technology have implications for military applications, cyber security, electricity grid security, and the movement of goods inside the U.S. Further, notes Jaffe, the movements of goods in the U.S. has a major influence on the competitiveness of exports, and the competition of manufacturing versus importing foreign goods. Thus, policies that have knock-on effects need to be fully scored.