Two years of R&D later…March feature in DCEO, “The Really Wild AI Ride.” See more.

“Keep turning the pages and you’ll read a scintillating feature from energy expert Jennifer Warren on the pioneers in AI and the data center space shaping the digital infrastructure’s next frontier.”

March 2025 Speaking Tour:

Women, Tech and Energy

DCEO’s November 2024 energy edition

Decomposing “Long Runway for New Energy Demand” with some comparisons to highlights from a Fed energy conference 11/18/24

ideas live on. Killed my own story for cause. A reference two years later in a cool journal.

After seeing unusual traffic from Thailand, Indonesia, and the Philippines regarding this work, I learned that the story was a reference in an academic publication by Berkeley Haas professors with an elegant solution. It’s a working paper here too. (Research highlighted here as well.)

NYC investor summit, June 2024:

Energy, infrastructure scene and the evolving economy

Two decades into the shale revolutions, the U.S. hydrocarbon scene and the related infrastructure build out is robust. Global supply and demand fundamentals are creating new and different opportunities. Firms are adapting models geared for a changing energy landscape.

Speakers included: Invesco, Coinbase, Principal Asset Management, Fidelity, JP Morgan, Cantor Fitzgerald, Schwab and other leading firms and experts. The program topics include today’s market and the outlook for the future of AI, Crypto, Healthcare, Shipping, Energy, and more.

Thought leadership WITH OTHERS: Across Three decades

My work life began in the Internet pre-1995, a date which apparently marks the Internet’s beginnings. I built my own website in 1996, and never since! From the late 90s onward, I worked between the CEO and executive-level CMO, essentially in a strategy and data analytics role in financial services products and national marketing. The products were complex, expensive and required considerable education to market and sell.

Through R&D efforts, I helped creatively translate findings into product development, business strategy and successful integrated, marketing campaigns. This early thought leadership work was put uniquely into action through 2000-2010 in a large family-owned business that partnered with major insurers such as Allianz, Travelers and others.

From of this knowledge, an evolving white paper that spanned ~20 years, was presented to the largest pension funds in the world. I still own domains specific to the work related to portfolio development. Since then, other domains have been collected. A 2020s iteration of this approach was applied to a client in 2022-24, and an early Internet version from 2003-today has continued to evolve as well.

Re-industrialization: “The resurrection of an Industrial Ghost Town,” Apr 2024, D CEO

The Sandow Lakes Ranch development stands as a model of sustainable development but also reflects the shifts occurring across the globe to accommodate technology and innovation. The need of the day points to multidisciplinary approaches and non-waste. Adding advanced manufacturing and reindustrializing means creating space for the new with the old in mind. (click image for more)

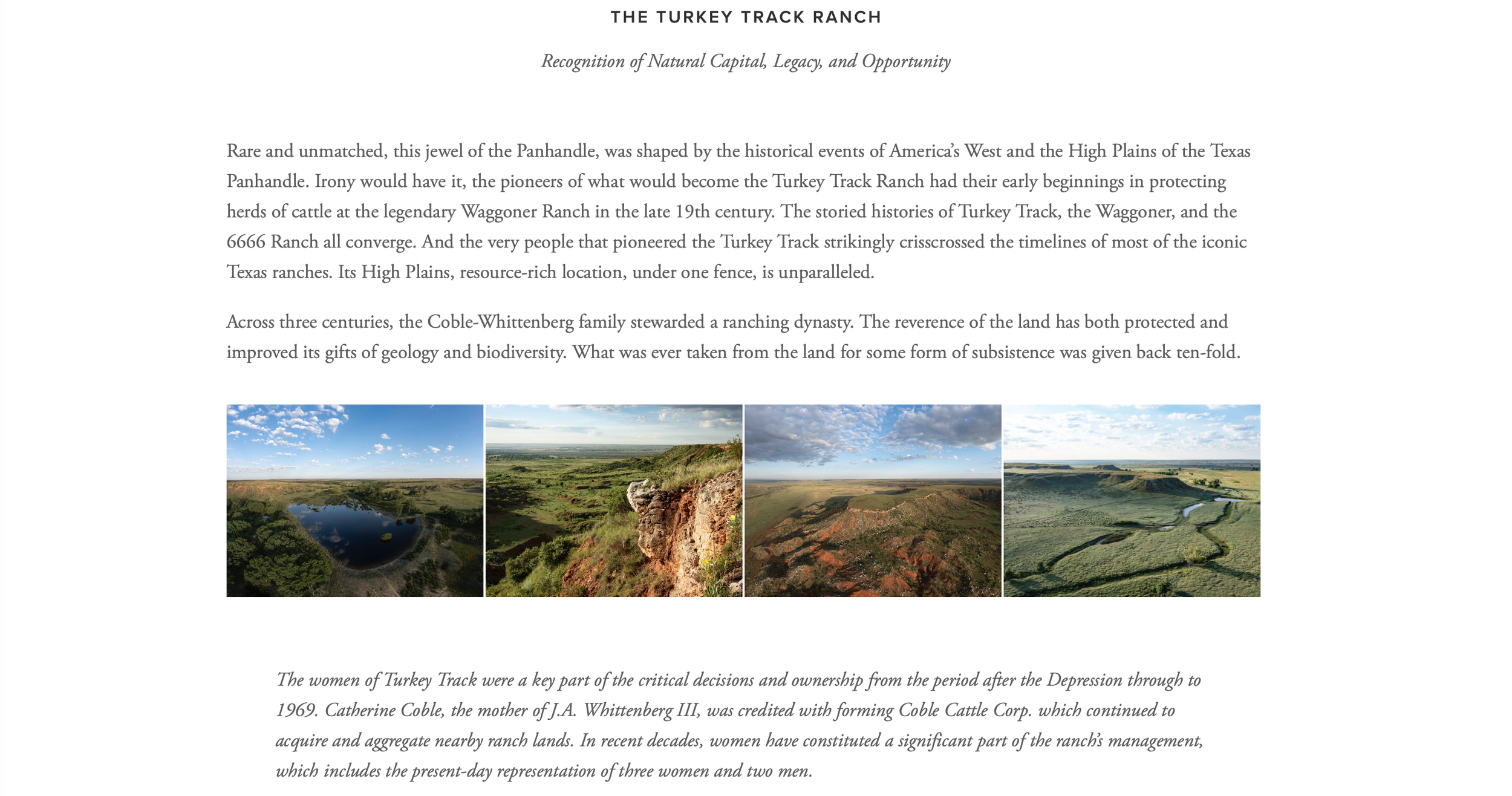

Resources & portfolio development projects

Bringing a vision of next-gen energy, land and resource allocation, with knowledgable partners. More information by request.

Speaking on energy, resources, innovation: WITH IVYFON, SEEKING ALPHA, UNIVERSITY OF MONTANA AND MY YOUTUBE CHANNEL

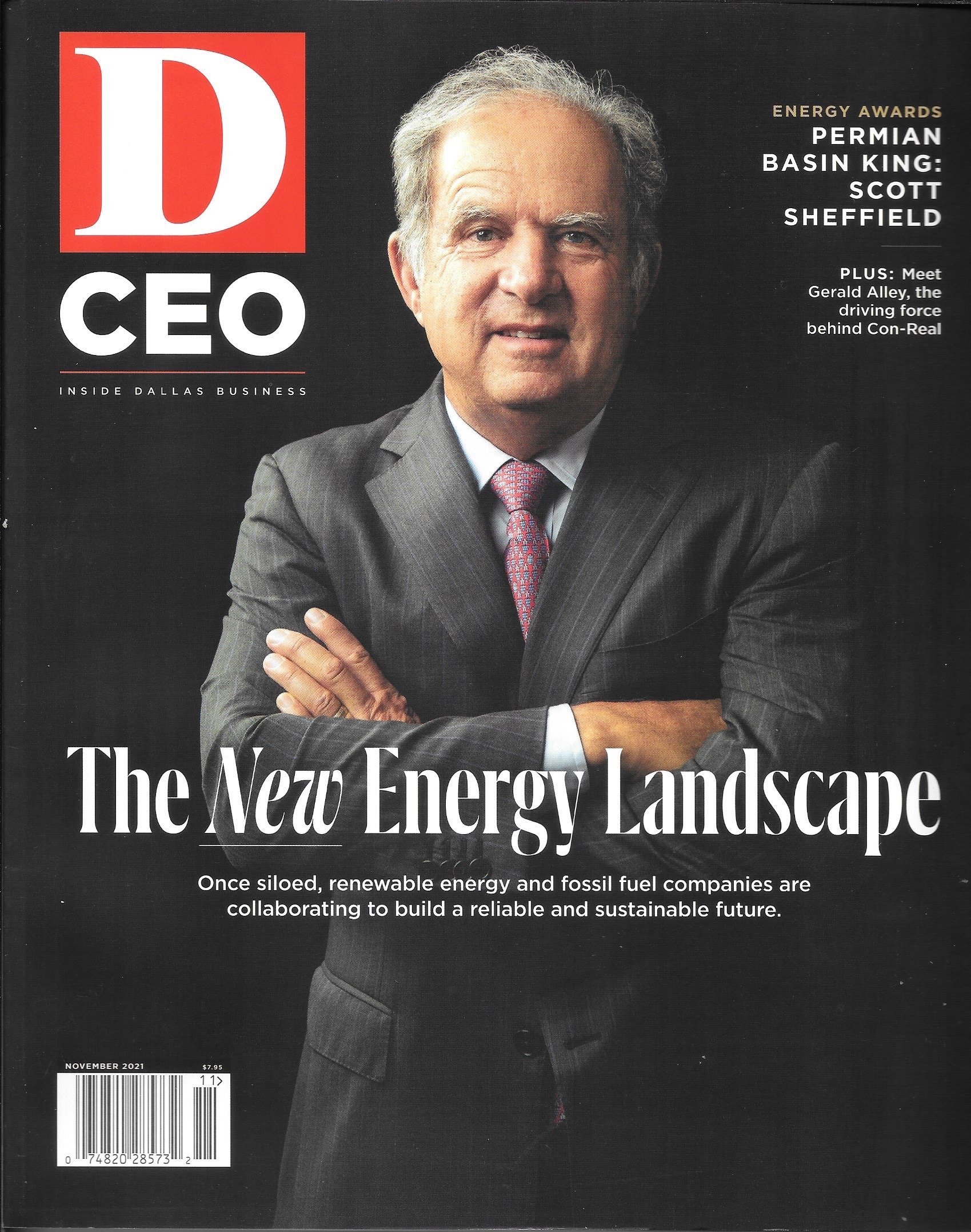

2023 with PARTNER, D CEO Magazine

“I want to take a moment to recognize an invaluable member of the D CEO team. For more than a decade, we have been fortunate to have had Jennifer Warren lead our energy coverage. Jennifer is known not just regionally or nationally but globally for her expertise, which spans energy trends, and their economic and geopolitical implications, and resource sustainability issues.

The energy CEOs we feature love talking with Jennifer because she knows their business—like no other. In recent years, Jennifer has written D CEO features on Scott Sheffield, Trevor Rees Jones, and George Yates. And this year, she wrote a must-read profile of Kelcy Warren. We’re grateful to her and proud to collaborate with her. Here’s more from Jennifer.”

IN THE FIELD

Fall 2022 with D CEO

Developing Thought Leadership for Two Decades with academia

“I don’t say it enough, but many thanks for all you do. Your work is very important to us—not just the mar/com department, but to the faculty. It’s so important for them to work with someone who “gets them.” Thank you for continuing to stick with us. — ”

SMU Cox faculty research knowledge site, 2004- present

Profiling of the Cox School of Business’ highly prolific researchers: 2004 - present, with over 300-plus academic papers profiled:

Recent work here.

Firms’ Supply Chain Risk: Nobody Really Knows (link) | Financing Crypto Firm’s Projects: An Unlimited Token Offering (link)| National Security Law Deters Foreign Investment (link) | Emissions Disclosures… (link)| Visual Finance and Investor Behavior (link) | Valuation of the FAANG Stocks (link)

Publications

Body of work from D CEO magazine, 2007-present

Since the inception of D CEO, numerous articles related to Dallas-based energy firms, infrastructure giant Fluor, and leaders and trendsetters have been written.

BOOK CHAPTER: “Targeting the Future: Smarter, Cleaner Infrastructure Development Choices” | Climate Change, November 2012

China and India, with their high economic growth trajectories, offer the planet a significant opportunity to reduce carbon emissions provided they invest in climate-smart infrastructure. The globe is also becoming increasingly water stressed. Understanding the energy-water-climate nexus is critical to achieving sustainable development. View chapter

Cover story: “Paving the Path for India's Growth” | Far Eastern Economic Review, March 2008, with co-author Dr. Andrew Chen, distinguished professor of finance

For India's rapid growth to continue, investment in infrastructure would need to double, from 5% of GDP to an estimated 9% by 2012 -- or $500 billion. Utilizing global capital markets and the private sector is the way forward for greater efficiency, transparency, and proper incentives. Incumbent approaches in financing infrastructure have shortcomings that encourage waste, inefficiency, and corruption. India is perfectly poised to leverage a new market-based approach for sustainable infrastructure development to the benefit of its economy, the Indian public, and global investors.

FEATURE ARTICLE: “The Chinese Connection” | D CEO, January 2008

Profile of CEO Patrick Jenevein of Tang Energy, a U.S.-based energy firm focusing on wind energy development and green tech processes in power generation, with rich experience in China. Illustrates a firm uniquely addressing the pollution problem in China, one consequence of rapid economic growth and high demand for energy. Link to article.