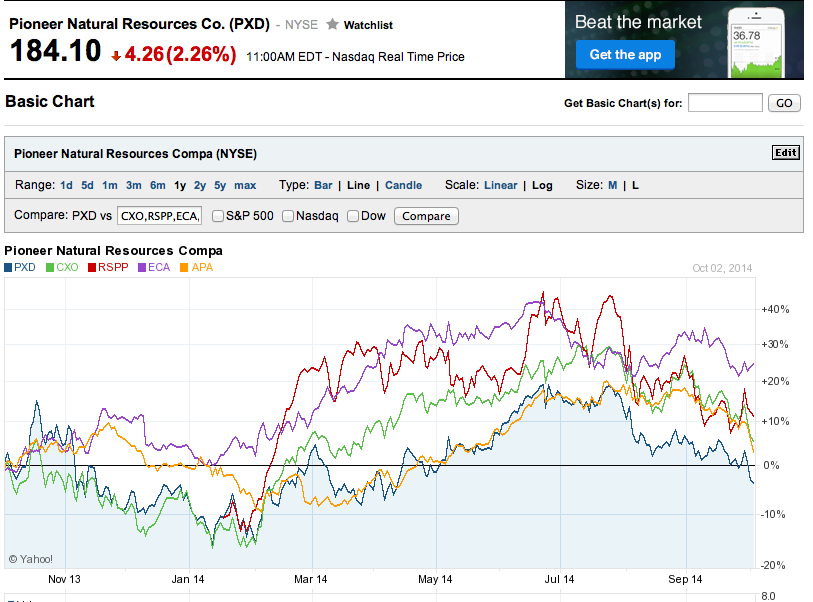

As of October 23rd, a floor may have firmed up beneath oil prices in the low $80 range for WTI. Major oil field services firm Halliburton does not see signs of its customers altering production plans at present. Large independent producer Occidental Petroleum notes in its earnings call for the third quarter that they are not making any deviations from earlier plans in the Permian Basin. (See a more in-depth article about oil market fundamentals and market players, "Global Oil Markets: There and Back Again.") From last week, when the bottom was nowhere in sight, the oil market appears to be finding its equilibrium, rising up from the lower $80s for both WTI and Brent crude prices. This series of articles provides numerous charts of fundamentals, including what margins a few key Permian Basin players rely on to produce profitably:

- "Global Oil Markets Finding a New Groove?" Oct. 16th here.

- "Fundamentals of Pioneer, the Permian Basin, and Oil Prices," Oct.15th here.

- "Oil Market Karma Reversed?" Oct. 9th here. And an update to that article: "The OPEC Oil Market Gambit," Oct 14th here.

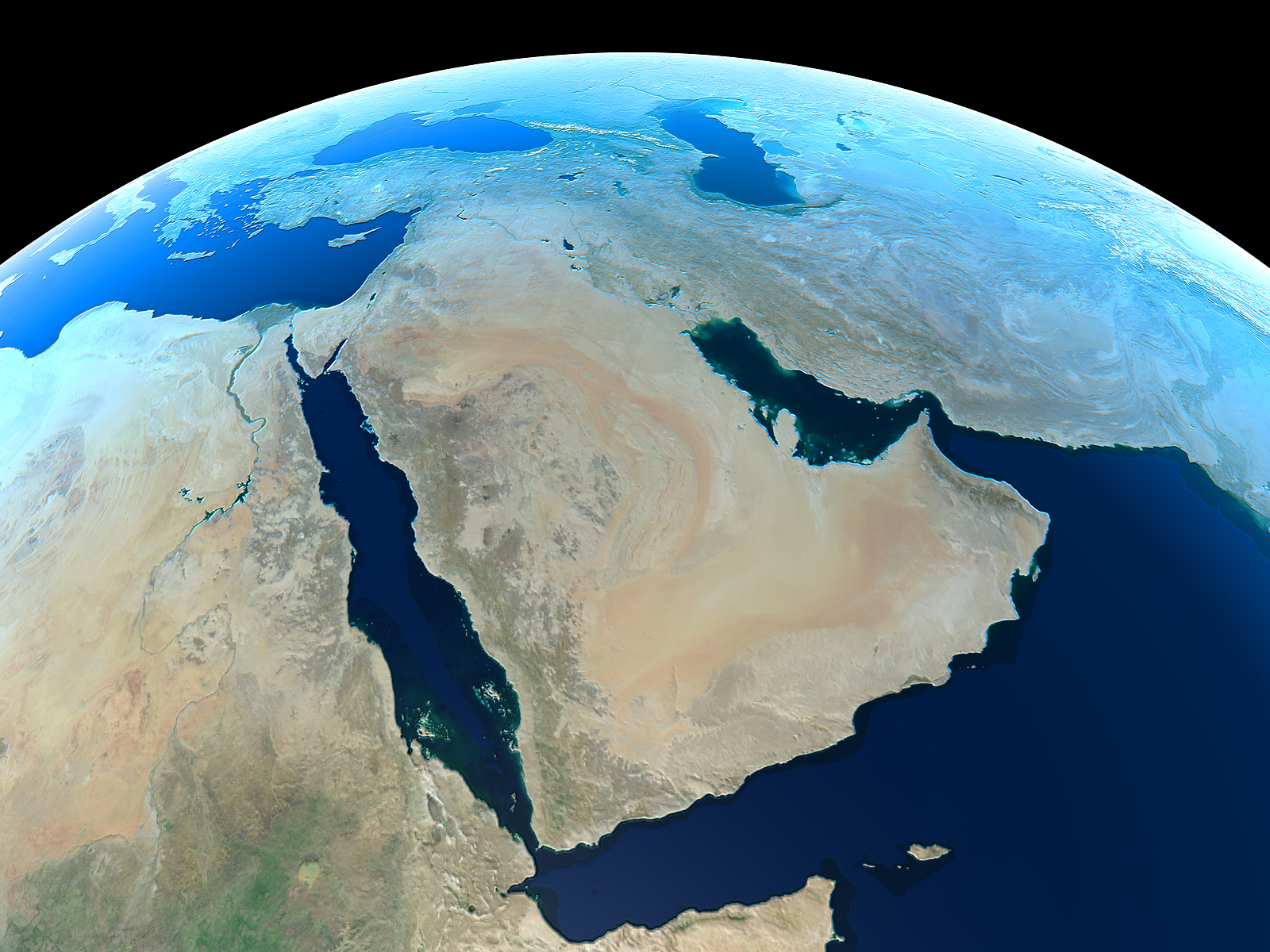

The expert insights in the "Global Oil Markets..." article are derived from the commenter very recently visiting Saudi Arabia.

The expert insights in the "Global Oil Markets..." article are derived from the commenter very recently visiting Saudi Arabia.