The University of Montana’s 20th International Conference on Central and Southwest Asia, with the Montana World Affairs Council, was held October 11-12, 2023. The following keynote presentation was given below:

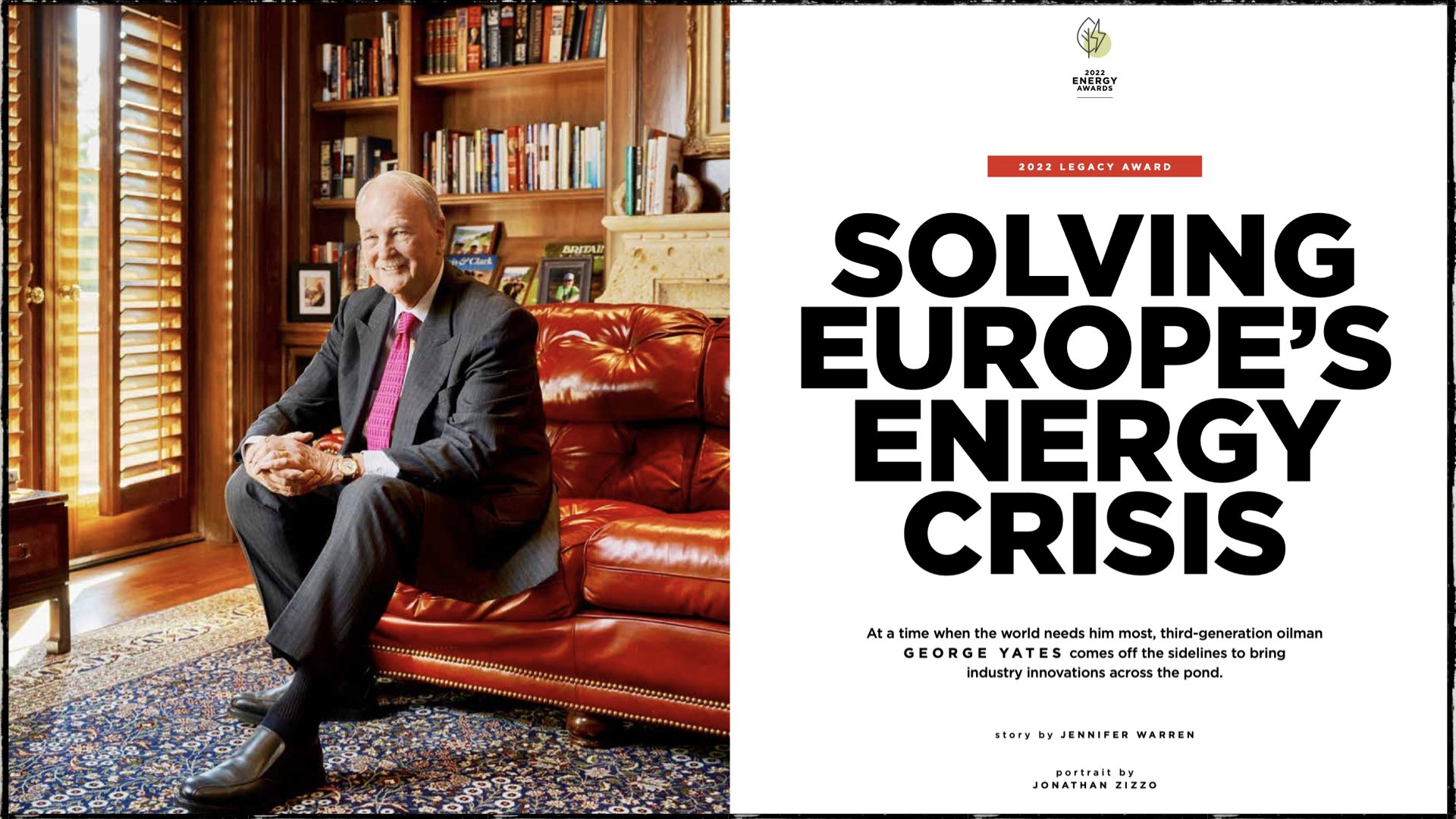

Chronicles in Energy and Geopolitics: The Past, Present and Future Possibilities

20th Annual International Conference

Central and Southwest Asia

If you want to learn about the roots of the current crisis, see the video, “U.S.,China, Israel, Saudi Arabia…”. Begin at around minute 50:00. Dr. Kia is a scholar of scholars. The last video added was the Consul General of Israel (San Francisco) in “Charting a New Course…” He begins at ~minute 5:00.

I interview former Montana Governor Brian Schweitzer on “International Conflicts and Energy Crisis” and also answer some audience questions. See playlist: at minute ~44:00 of video.

Backgrounders

Below are some recent works that offer background to my talk.

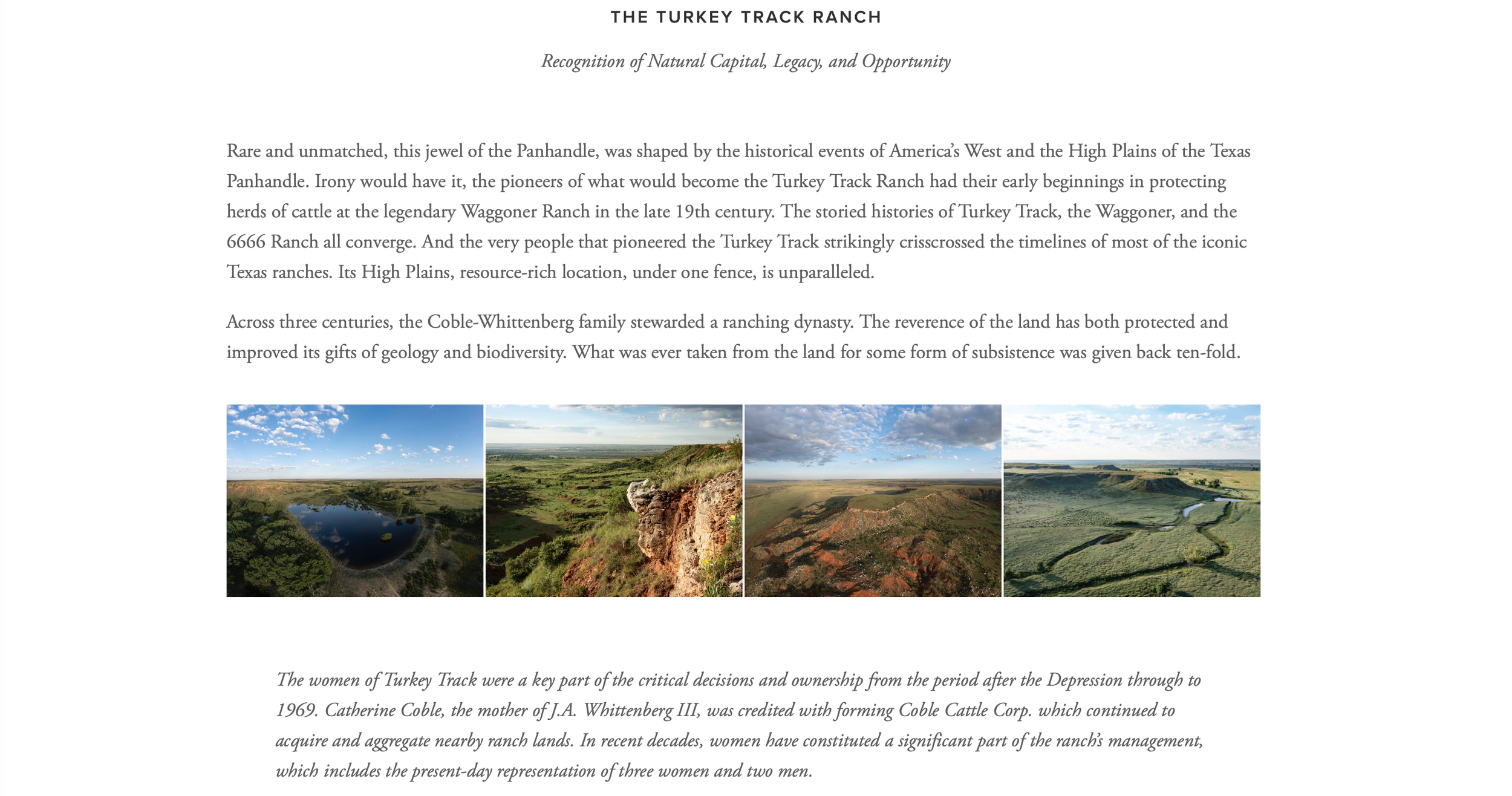

Some various and sundry images connected to recent work— for and with others.

My Influences: professors in finance, economics, physics and global affairs

Dr. Brom, Professor of Russian. His 1982 “Where is your America?” essay only now makes more sense (original PDF too).

Dr. James Smith, financial economist and energy expert. Profiled his work about U. S. shale and oil markets plus OPEC.

Dr. Andrew Chen, a world’s most prolific and distinguished professor of finance. Capital markets-based approach to finance infrastructure (see latter part of publishings and a note about our work at the end of the page).

Dr. Geoffrey West, theoretical physicist. I invited him to speak at DCFR, and interviewed him about his emergent theories. Ultimately the book “Scale” detailed it all. It was another lens for my resources work.

With respect to cities, even if we want to change the future, we haven’t left ourselves enough time. This is a real problem and the challenge. Incidentally, we should have been thinking about the drivers underlying cities 50 to 75 years ago. — Dr. West interview of 2012

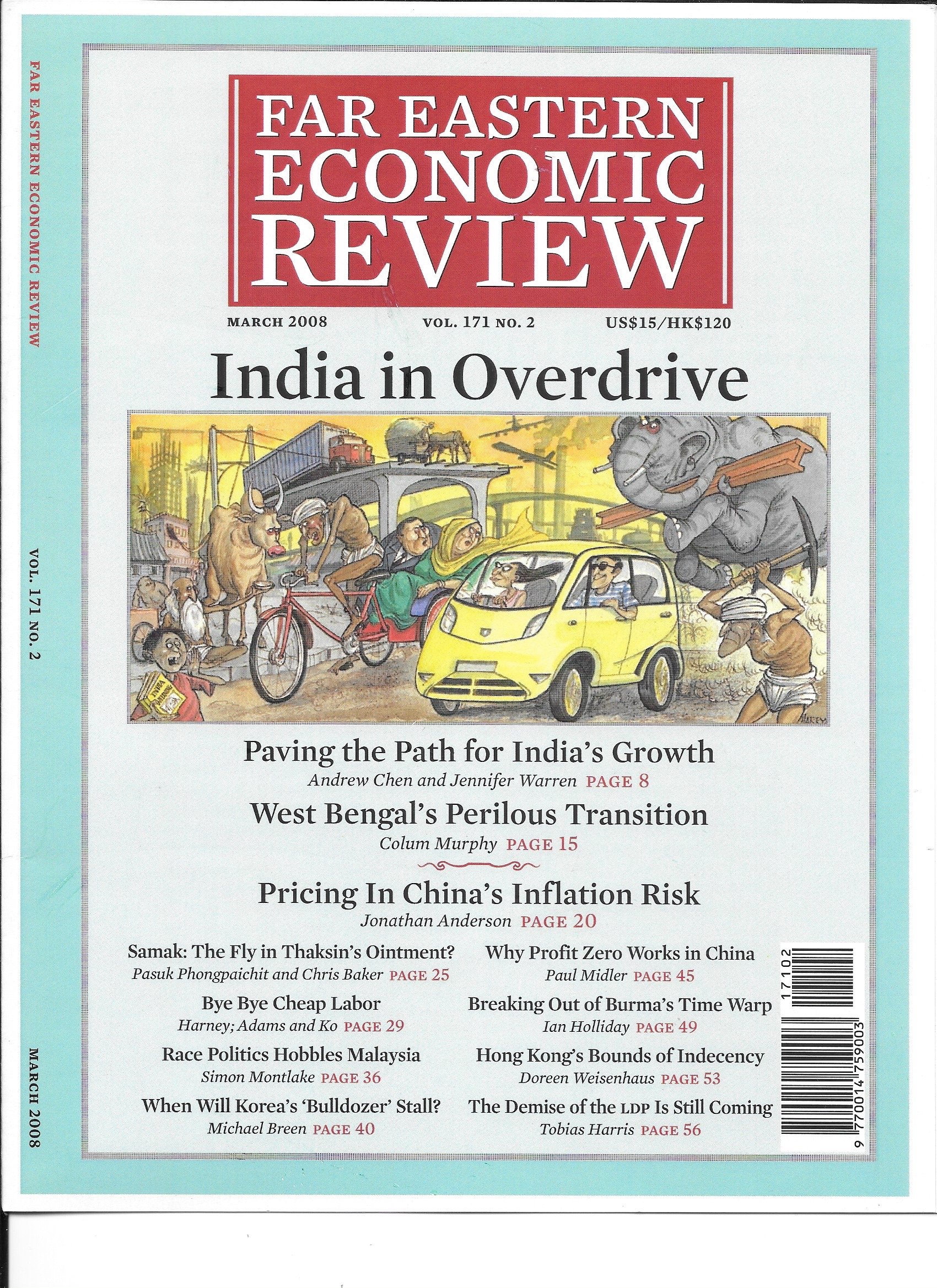

Work with Dr. Andrew Chen, distinguished finance professor, emeritus, Cox School of Business, SMU

Using Capital Markets to Finance Infrastructure

Our work on the capital market-based approach to finance large-scale infrastructure development began when Jennifer asked if she could either use an idea from a working paper as a citation or join her in co-authoring a 2005-06 World Bank essay competition about efforts that advance global development.

I joined in. After that, we applied the approach to India’s infrastructure development as the country needed private capital beyond the capacities of the government in Journal of Structured Finance (summer 2007). Jennifer saw how the theory could be applied to India’s situation. A Far Eastern Economic Review editor saw the academic paper and requested we write a policy-practitioner version, which became the 2008 cover story “Paving the Path: For India’s Growth.” We then applied it to China’s sustainable growth in The Chinese Economy (2011), and included more water infrastructure as it was emerging as a major concern. Jennifer had been researching water stress issues since 2003.

A book chapter then ensued also by editor request, “Targeting the Future: Smarter, Cleaner Infrastructure Development Choices,” for a climate change book in 2012; it offered ways to finance energy infrastructure and curb growing carbon emissions, particularly for the growth economies of India and China. In 2021, Real Leaders published a brief version of our combined ideas, as a way to boost the sustainably-oriented infrastructure that governments and economies want and need. Jennifer was always good in seeing the practical application of my theory.

Jennifer’s interest in sustainable resource development and addressing climate issues was a critical part of the work, as well as her ability to apply research to pressing global problems of the day. She is continuing to apply this work in her natural capital practice, alongside developments and advances in energy infrastructure. She is quite adept at seeing how to utilize capital markets and convey complex ideas to various stakeholder groups to further economic opportunity.

— Dr. Andrew Chen, September 2023