Re-published from Dialogues, United States Association for Energy Economics With OPEC's attempts to constrain supply, U.S. shale's incentives, and plenty of geopolitical intrigue ahead, a definitive guide to oil markets seems elusive. In the Energy Information Administration's (EIA) short-term report, global petroleum and other liquids consumption growth is expected to be about 1.6 million b/d in 2017 and 1.5 million b/d in 2018, with most of the growth from China, India and the Middle East, particularly Saudi Arabia. Still, they expect OPEC crude to grow from 33.2 million b/d in 2017 to 33.7 million in 2018.

Just Right?

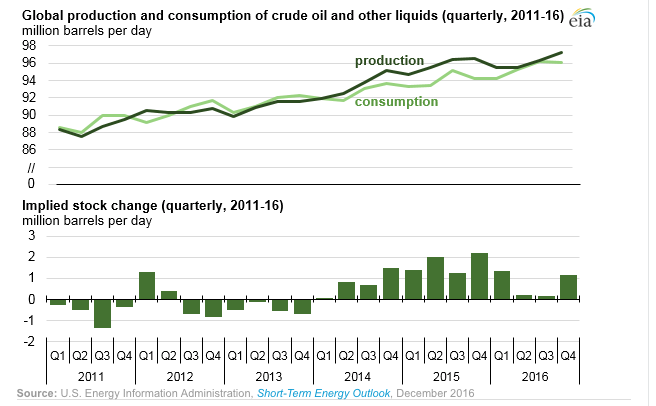

In 2017, demand appears to soak up past excesses and align more with production. And 2018 offers the impression of a tighter picture of the balance between supply and demand. Will these be the Goldilocks years for consumers?

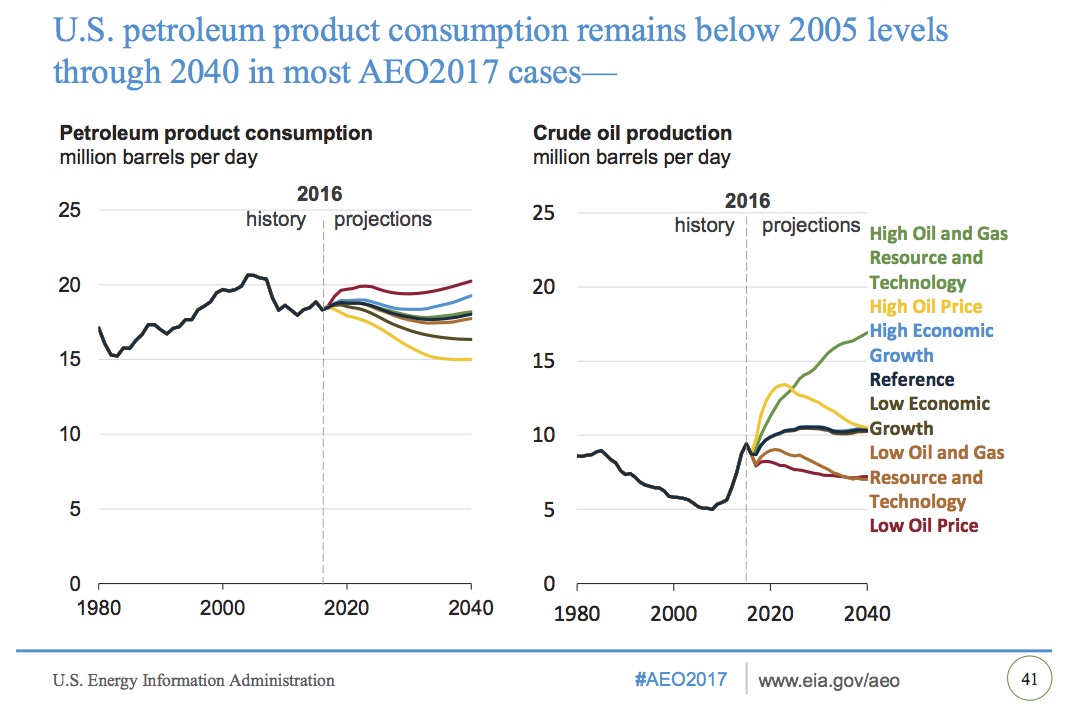

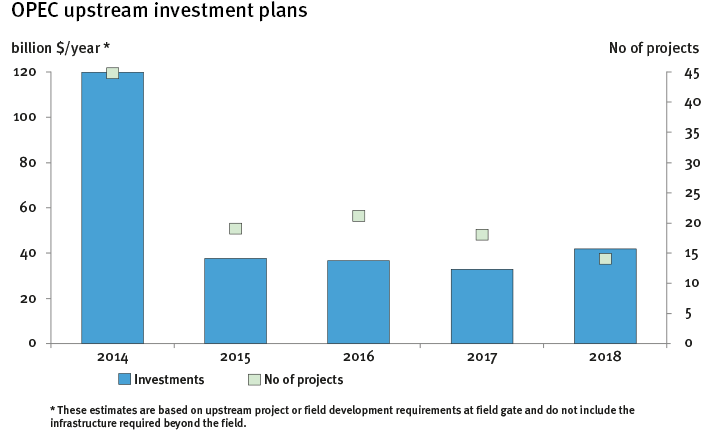

Many variables underpin the longer view of the composite that is price. The EIA recently estimated a high oil price case considering the impact of higher world demand for petroleum products, lower OPEC upstream investment, and higher non-OPEC exploration and development costs. And a lower price case assumes the opposite. The difference between the two cases is roughly 5 million b/d in consumption in the U.S. For context, in 2014, OPEC planned upstream investment was about $120 billion, declining to less than $40 billion each year thereafter to 2018 (see chart at end of article). According to analysts Wood Mackenzie, global upstream investment reverses its decline in 2017, with a "recovery" level of over $500 billion of investment expected in 2019.

Price Making

The influence of Saudi Arabia, however, still matters for global oil, as noted by economist Alhajji in the first article. James Smith, USAEE past president, offers color about the Saudi's situation: "The Saudis’ problem is that they have too much oil—more than they will ever be able to sell given the rise of shale, the likely taxes and prohibitions due to climate change concerns, etc. If they don’t sell it now, they never will."

Smith cites a "market share trap" for which he learned about twenty-five years ago from his days at university studying under Professor Adelman of Massachusetts Institute of Technology. "They [Saudi Arabia] can boost the price of oil by cutting production," Smith says, "but working against so many competing suppliers and dwindling demand, they would soon be limited to 0 barrels in the attempt to keep prices at $100. They have moved on."

In the near term, spot price volatility is still expected. The political risk component of supply outages isn't diminished with an OPEC quota given the risks in the neighborhoods of Iraq, Iran, Nigeria, Libya, Saudi Arabia and Venezuela, to name a few. The inelasticity of supply and demand are still central to oil pricing too, in spite of the addition of U.S. shale oil. "The time required for shale to ramp up to offset these outages (drawing well permits, mobilizing rigs, completing wells) is measured in months of years, not days," offers Smith. "Volatility of the spot price of oil depends on the almost immediate need to rebalance markets when supply flags or demand surges."

In considering the year ahead, economic growth and consumption inform a view of the demand for oil. In The Economist's outlook for 2017, China and India's GDP growth is expected to be 6% and 7.5%, respectively. Other Asia, excluding New Zealand, Australia, and Japan is expected to grow 5.2%, while Australasia is 3% to North America's 2.3% and Western Europe's 1.1%. The Middle East and Africa are forecast at nearly 3%. The EIA projection for real oil-weighted world GDP growth increases slightly from 2.2% in 2016 to 2.7% in 2017.[i] Demand marches on, but dollar strength will matter too.

Mixing It Up

The transportation sector, a major driver of oil demand, is changing in new ways that is yet to be fully calculated. For example, many commercial fleets have or are considering the switch to natural-gas powered vehicles, and the growth is expected to continue. However, the costs versus the benefits are being weighed in consideration of oil and diesel pricing and new information related to the lifecycle emissions of methane when the entire supply chain is studied.[ii]

Ridesharing usage and the changing mix of light-vehicle ownership from conventional to hybrid and electric vehicles influences gasoline consumption. With Tesla's new Nevada-based Gigafactory, lower battery costs envisioned by Tesla will power an initial 1.5 million of its own electric vehicles. The International Energy Agency suggests electric cars grow from 1.3 million in 2015 to 30 million in 2025; oil demand could be reduced between 1.3 million to 6 million b/d by 2040 depending on policies (and of course adoption). With more definition about U.S. energy policy anticipated, a world of constituents —investors, firms, consumer groups, and policymakers—have voted for the Paris Agreement to reduce carbon emissions.

Predicting the exact nature of oil markets in the long term is challenging. But the year ahead looks to offer continued lower prices, in a relative sense, to support the economic prosperity that many countries hope to advance.

Jennifer is a writer and communications specialist focusing on energy, resources and thought leadership work for companies and institutions. Her work has appeared in numerous academic, policy and business publications.

[i] http://www.eia.gov/outlooks/steo/marketreview/crude.cfm

[ii] http://blogs.edf.org/energyexchange/2017/01/06/new-study-improves-understanding-of-natural-gas-vehicle-methane-emissions-but-supply-chain-emissions-loom-large/